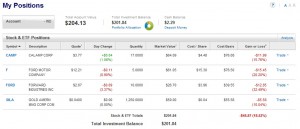

Here is my stock portfolio (I erased the account number for obvious reasons):

(click on the image to expand)

Well, it’s been almost a month now and I wanted to report back on how my stock experiment has been doing. In good news, Ford and CalAmp both posted better than expected returns, not much news about Forward Industries, and the American Gold Mining Company just posted a -5800% (yes that is a negative) return for Q2. You would think looking at this data Ford and CalAmp should be up and the American Mining Company should of tanked, right?? Wrong.

American Mining Company actually rose a penny this month, which means I am actually now at my cost per share basis (the cost of the share when I bought it that included my comission costs). If it rises just one more penny, I will actually make a good profit. Why, I don’t know, for all practical reasons, this stock should be crashing faster than celebrity after a film screening, but it isn’t. Owning gold stock is not the same as buying gold. I bought this stock not expecting it to do anything for quite some time. The idea of making money with gold stock is you don’t actually get anything unless they find gold in the mine (which they haven’t yet), so the idea that the stock would suddenly change value is baffling.

As far as Ford and CalAmp go I don’t get it either. I was taught in school that if a company makes a profit, that’s good. I was also taught that, if a company makes a better than expected profit, that is even better. By every reasonable measure I can think of these two stocks are undervalued. If you look at the historical records Ford should be in the $18 range and CalAmp should be around $6. Apparently, that logic only applies in school.

Forward Industries is the stock that has lost the most value since I bought it, but considering it only needs to raise $1.50 to make a profit I am not too worried yet. There hasn’t been really much of any news for this company so the fact that it has declined this much is very strange.

Very strange news all around, unless of course you factor in one little news story. The debt ceiling!! It is the only logical explanation I have at this point for why my stocks are doing so bad. I guess the lesson here is, it doesn’t matter if you do your research and try to make a sound decision because there will always be a loose factor out there that you can’t account for in your research. Unfortunately, my loose factor is a bunch of politicians that seem to think their job is to make up zingers rather than to actually vote on something. Overall, the DOW has already given up about 400 points since I made my buy, it will be interesting to see what it does in August.